Leveraging the Small Business Provisions of the CARES Act

On March 27, 2020, the Coronavirus Aid, Relief and Economic Security (CARES) Act made available $2 trillion dollars in economic relief to groups impacted by the coronavirus pandemic. The stimulus package is designed to help businesses and individuals during this unprecedented time.

On April 24, 2020, an additional $380 billion in economic relief was made available to small businesses impacted by the coronavirus pandemic.

This document summarizes a few key aspects of the CARES Act that could be beneficial to small business owners, including staff or individual workers impacted by COVID-19.

Paycheck Protection Program (PPP)

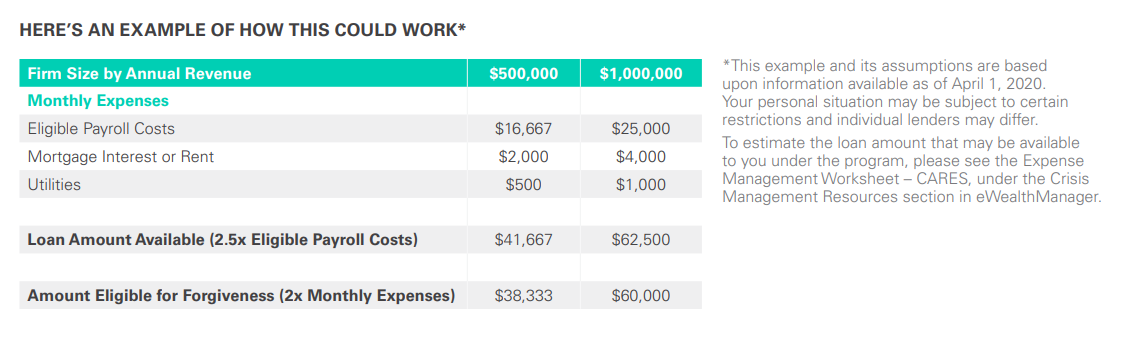

The Paycheck Protection Program provides loans to small business owners harmed by COVID-19 between February 15-June 30, 2020. Under the program, small business owners receive expanded access to Small Business Association (SBA) loans for the use of eligible business continuity needs, up to 2.5 times payroll costs or a maximum of $10 million. Part or all of the loan may be forgivable and debt service payments may be deferred for up to six months. Please work with your preferred lender on eligibility and terms.

If the following criteria applies, small business owners can apply through any 7(a) approved SBA lender before June 30, 2020:

Economic Injury Disaster Loan (EIDL)

EIDL is available when a governor declares a statewide disaster and a small business owner is able to demonstrate harm resulting from this disaster. These loans require full repayment and are subject to full underwriting.

- Loans up to $2 million

- Interest rate of up to 3.75%

- Principal and interest may be deferred for up to 4 years

- Term up to 30 years as determined by the SBA, and your ability to pay

The CARES Act also permits EIDL applicants to request an advance of up to $10,000 to pay allowable working capital needs. These funds are available to small businesses, nonprofits, sole proprietors, independent contractors, tribal businesses cooperatives, and employee-owned businesses.

Debt Relief for Existing and New SBA Borrowers

$17 billion has been made available for small businesses with a new or existing standard SBA 7(a), 504, or microloan.

- SBA will make principal, interest, and fee payments for six months

- May also include lender assistance with temporary extensions on reporting requirements